44+ rising rates are battering mortgage lenders

7 Best Business Loans of 2023. Web Mortgage rates have been rising over the past year jumping more than three percentage points.

Real Estate Industry Not Immune From Trends Battering Overall U S Economy Real E Savvy Magazine

Mortgage giants including Wells Fargo Co.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JRKIH3MH7VLEDAPE2VWNXLIQRY.png)

. Web Wall Street Journal May 25 2022Orla McCaffrey subscriptionMortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest. Web Rising Rates Are Battering Mortgage Lenders Summary by Wall Street Journal Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. So overall mortgage volume mortgage resignations are expected to be down 41 this year which is quite a lot thats according to the Mortgage Bankers Association.

Web The benchmark fixed rate on 30-year mortgages now sits at 63 percent down from last months levels according to Bankrates national survey of large lenders. Web The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200 or less increased to 372 from 364. Mortgage Finance and Banking Real Estate Please note that in order to view the content for the Bankruptcy Headlines you must either sign in if you are already an ABI member or otherwise you may Become an ABI Member.

The 30-year rates could jump above 4 this year but thats still low compared to a few years ago. Thats an increase of about 625 per month. Compare Lowest Mortgage Refinance Rates Today For 2023.

Apply For Up To 2M. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Make a loan 3.

No SNN Needed to Check Rates. Web The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200 or less increased to 450 from 427. Web Orla McCaffrey.

Web But rates for those mortgages have bounced back up since then and on Friday they hit their highest level since 2018. While home prices continue to rise and Americans are still buying houses the drop-off in refinancing activity is a giant blow because refinancings made up the bulk of US. Average 30-year fixed mortgage rates are now around 6 or more.

Web Mortgage lenders also grew more pessimistic about the larger economy in Q1 2022 with 59 now reporting that the economy is on the wrong track compared to 29 in Q1 2021. Web Roughly 85 of borrowers have a mortgage rate locked in below 5 according to a Redfin report. Web Rising Rates Are Battering Mortgage Lenders Wednesday May 25 2022 Article Tags.

The Best Lenders All In 1 Place. While this article focuses mainly on the housing industry I think it does a. Web Mortgage lenders typically offer lower interest rates to borrowers who go shorter than 30 years because the shorter term means the lender recoups its investment faster.

Grow Your Business Now. Ad Low Fixed Mortgage Refinance Rates Updated Daily. Ad Get a Business Loan From The Top 7 Online Lenders.

Mortgage applications to purchase a home fell 2. Web She is stating that we need at least 20 down but that our interest rate is going to be between 2-4 higher than the current average mortgage rates even with 20 down. Web In an April 13 report the Mortgage Bankers Association forecast that overall mortgage originations will likely fall by about 36 in 2022 compared to a year earlier to about 258 trillion.

With our combined income we wouldnt have any issue getting approved for the mortgage value one a single family home at this value. Web Mortgage rates were at record lows in 2020 and 2021 but theyve been increasing in 2022. Web Lots of talk and rightfully so about rising interestrates and their effect.

Refinance applications fell 13 for the week and. I wish I understood financing better. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise.

The 30-year fixed-rate mortgage averaged 555 in the week ending August 25 up from 513 the week. If anyone of those slows.

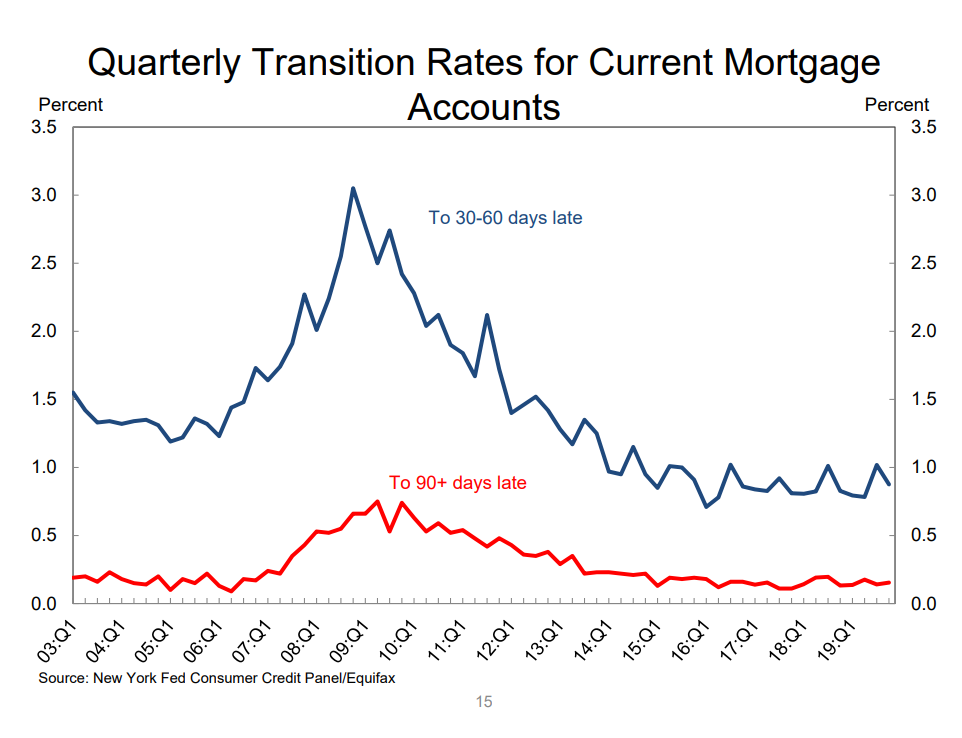

The Good The Bad And The Ugly Of American Borrowers The Irrelevant Investor

Inside The Collapse Of Rmf America S Fifth Largest Reverse Mortgage Lender Reverse Mortgage Daily

The End Of Ultralow Rates Is Battering The Stock Market Barron S

What Are Mortgage Lenders Options In A Rising Rate Environment

Mortgage Demand Falls As Interest Rates Rise

Top Bank Stocks Kicking Off Us Q2 Earnings Season

Mortgage Applications Fall 14 As Higher Rates Hurricane Ian Crush Demand

Soaring Interest Rates Weigh On Big Bank Mortgage Loan Growth Reuters

Signs Of Resilience Mortgage Demand Plummets To Lowest 2023 Level As Rates Rise For Second Week But Experts Predict Cooling Rental Prices Will Eventually Bring Rates Below 6

Option Compensation Risky Mortgage Lending And The Financial Crisis Sciencedirect

Rising Rates Are Battering Mortgage Lenders Wsj

Bank Of Ireland Increases Fixed Mortgage Rates By 0 25 Reuters

Dearth Of Credit Starves Detroit S Housing Market Wsj

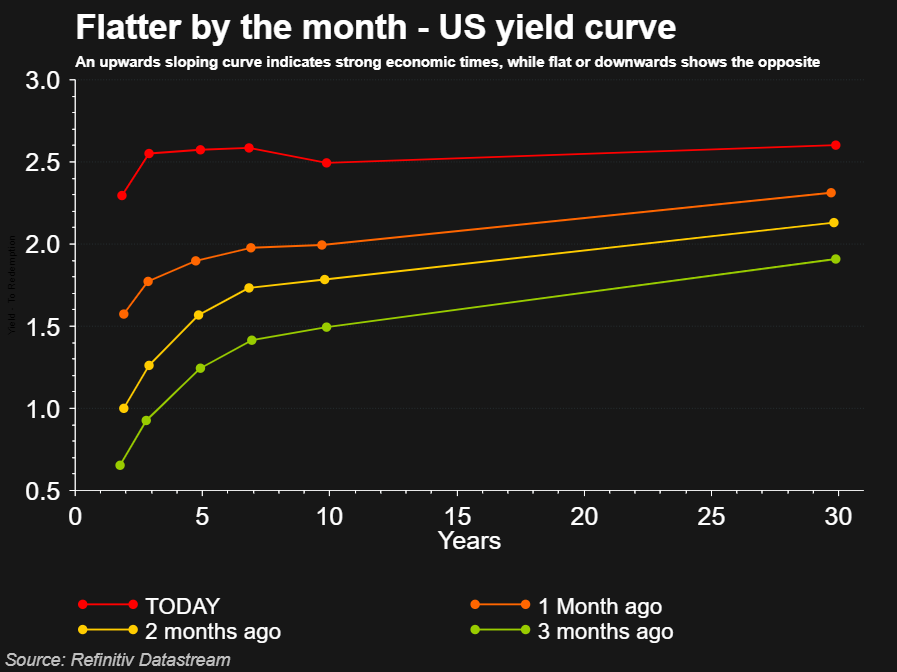

Explainer Yield Curve Flattening And Inversion What Is The Curve Telling Us Reuters

Rising Rates Are Battering Mortgage Lenders R Rebubble

Pdf Money For Nothing And Checks For Free Recent Developments In U S Subprime Mortgage Markets

Mortgage Lenders Pull And Increase Headline Rates Ftadviser